Share from The Mortgage Report blog

?

What Is An FHA Streamline Refinance?

The FHA Streamline Refinance is a special mortgage product, reserved for homeowners with existing FHA mortgages. Homeowners with conventional mortgages via Fannie Mae or Freddie can?t use it. FHA Streamline Refinances are the fastest, simplest way for FHA-insured homeowners to refinance their respective mortgages.

The FHA Streamline Refinance program?s defining characteristic is that it does not require a home appraisal. Instead, the FHA will allow you to use your original purchase price as your home?s current value, regardless of what your home is actually worth today.

In the words, with its FHA Streamline Refinance program, the FHA does not care if you are underwater on your mortgage. In fact, the program encourages it. Even if you owe twice what your home is now worth, the FHA will refinance your home without added cost or penalty.

The FHA allows for unlimited loan-to-value with its Streamline Refi program ??a huge help to FHA homeowners in places like Florida, California, and Arizona where home values have plunged since 2007.

Beyond the ?no appraisal? part, though, an?FHA Streamline Refinance mortgages is similar to most other loan products.?It?s available as fixed rate or adjustable mortgage; it comes with 15- or 30-year terms; and there?s no prepayment penalty to worry about.

Plus, interest rates are as low as with a ?regular? FHA mortgage product.

FHA Streamline : No Verification Of Job, Income, Credit

In April 2011, while the rest of the world was making it?harder to get approved for a mortgage, the FHA was making it easier.

In a sweeping guideline update, the FHA abolished verification for practically?everything on an FHA Streamline Refinance mortgage application. Now, as written in the?FHA?s official mortgage guidelines, the mortgage approval process for an FHA Streamline Refinance says :

- Employment verification is not required?with an FHA Streamline Refinance

- Income verification is not required with an FHA Streamline Refinance

- Credit score verification is not required?with an FHA Streamline Refinance

And, as mentioned earlier, there?s no need for a home appraisal, either.

Put it all together and it means that you can be (1) out-of-work, (2) without income, (3) with a terrible credit rating and (4) having lost all of your home equity ? and yet, you will still be approved for the FHA Streamline Refinance program.

That?s not as crazy as it sounds, by the way.

To understand why the FHA Streamline Refinance is a smart program for the FHA, we have to remember that the FHA?s chief role is to insure mortgages ? not ?make? them.

Therefore, it?s in the FHA?s best interest to help as many people as possible qualify for today?s low mortgage rates.?Lower mortgage rates means lower monthly payments which, in theory, leads to fewer loan defaults.

This is good for homeowners that want lower mortgage rates, and for the FHA, but mostly for the FHA.

Are You FHA Streamline Refinance Eligible?

Although the FHA Streamline Refinance eschews the ?traditional? mortgage verifications of income and credit score, as examples, the program does enforce minimum standards for applicants. The official FHA Streamline Refinance guidelines are below.

Perfect, 12-Month Payment History Is Required

The FHA?s main goal is to reduce its overall loan pool risk. Therefore, it?s number one qualification standard is that homeowners using the Streamline Refinance program must have a perfect payment history stretching back 12 months. 30-day, 60-day, and 90-day lates are not allowed. Furthermore, loans must be current at the time of closing.

210-Day ?Waiting Period? Between Refinances

The FHA requires that borrowers make 6 mortgage payments on their current FHA-insured loan, and that 210 days pass from the most recent closing date, in order to be eligible for a Streamline Refinance.

Employment And Income Are Not Verified

The FHA does not require verification of a borrower?s employment or annual income as part of the FHA Streamline process. There is no Verification of Employment, nor are there paystubs, W-2s or tax returns required for approval. You can be unemployed and get approved for a FHA Streamline Refinance so long as you still meet the other program requirements.

Credit Scores Are Not Verified

The FHA does not verify credit scores as part of the FHA Streamline Refinance program. Instead, it uses payment history as a gauge for future loan performance. This means that credit scores of below 620, below 580, and below 500 are eligible for Streamline Refis.

The Refinance Must Have ?Purpose?

Streamline Refinance applicants must demonstrate that there?s a Net Tangible Benefit in the refinance; a legitimate reason for refinancing. Loosely, Net Tangible Benefit is defined as reducing the (principal + interest + mortgage insurance) component of the mortgage payment by 5 percent or more. ?Refinancing from an ARM into a fixed rate loan is an automatic Net Tangible Benefit. Taking ?cash out? to pay bills is not an allowable Net Tangible Benefit.

Loan Balances May Not Increase To Cover Loan Costs

The FHA prohibits increasing a Streamline Refinance?s loan balance to cover associated loan charges. The new loan balance is limited by the math formula of (Current Principal Balance + Upfront Mortgage Insurance Premium). All other costs ? origination charges, title charges, escrow population ? must be either (1) Paid by the borrower as cash at closing, or (2) Credited by the loan officer in full. The latter is called a ?zero-cost FHA Streamline?.

Appraisals Not Required

The FHA isn?t concerned about home value ? it?s insuring your loan regardless. Therefore, the FHA does not require appraisals for its Streamline Refinance program. Instead, it uses the original purchase price of your home, or the most recent appraised value, as its valuation point. Homes that are underwater are still FHA Streamline-eligible.

FHA Streamline Refinance Mortgage Insurance Requirements

The FHA Streamline Refinance is an FHA-insured mortgage, and FHA borrowers are required to make two types of mortgage insurance payments ? an upfront mortgage insurance payment paid at closing, plus an annual one paid in 12 installments along with your mortgage payment each month.

Beginning April 9, 2012, how much you?ll pay in FHA mortgage insurance premiums as a streamline refi applicant depends on how long your current FHA-backed mortgage has been in place.

FHA Streamline Refinances are now split into two classes :

- Loans that replace FHA-backed mortgages endorsed before June 1, 2009

- Loans that replace FHA-backed mortgages endorsed on or after June 1, 2009.

Refinancing an ?old? FHA mortgages entitles FHA homeowners to lower MIP. Refinancing a ?new? one does not.

?

FHA Streamline Refinance MIP Rates (For Loans Endorsed Before June 1, 2009)

If your existing FHA mortgage was endorsed prior to June 1, 2009, your mortgage insurance premiums have been ?grandfathered?. You can refinance ia th FHA Streamline Refinance program and pay reduced rates for both for upfront MIP and annual mortgage insurance premiums.

Upfront MIP

Beginning for FHA Case Numbers assigned on or after June 11, 2012, and for loans endorsed prior to June 1, 2009, the new FHA upfront mortgage insurance is equal to 0.01 percent, or 1 basis point.

So, for example, if your FHA Streamline Refinance is for a new $100,000 mortgage, the FHA will assess a $1 upfront mortgage insurance premium (MIP) to be paid by you at closing. The FHA automatically rolls the $1 payment into your new loan balance.

This is a huge discount over the FHA?s standard UFMIP payment of 1.75%.

?

Annual MIP

Meanwhile, for FHA Case Numbers assigned on or after June 11, 2012, and for loans endorsed prior to June 1, 2009,?costs for the?other?type of FHA mortgage insurance ? annual MIP ? moves to a standard 55 basis points.

The new schedule, for loans with case numbers assigned?on or after June 11, 2012?:

- 15-year loan terms with loan-to-value over 90% : 0.55 percent annual MIP

- 15-year loan terms with loan-t0-value under 90% : 0.55 percent annual MIP

- 30-year loan terms with loan-to-value over 95% : 0.55 percent annual MIP

- 30-year loan terms with loan-to-value under 95% : 0.55 percent annual MIP

15-year fixed rate mortgages with LTVs of 78% or less pay no annual MIP.

Case numbers assigned?prior to June 11, 2012?will still use the current FHA mortgage insurance schedule :

- 15-year loan terms with loan-to-value over 90% : 0.50 percent annual MIP

- 15-year loan terms with loan-t0-value under 90% : 0.25 percent annual MIP

- 30-year loan terms with loan-to-value over 95% : 1.15 percent annual MIP

- 30-year loan terms with loan-to-value under 95% : 1.10 percent annual MIP

Note that there is no ?jumbo FHA mortgage premium? for FHA mortgages that pre-date June 1, 2009. This is a feature for loans endorsed on or after June 1, 2009 only.

?

FHA Streamline MIP For Loans Endorsed On Or After June 1, 2009

If your existing FHA mortgage was endorsed on or after June 1, 2009, your new FHA mortgage insurance premiums will reflect the current MIP rates.

Upfront MIP

For FHA Case Numbers assigned on or after April 9, 2012, and for loans endorsed on or after June 1, 2009,?the FHA?s new upfront mortgage insurance will now equal to 1.75 percent of your loan size.

If your FHA Streamline Refinance is for a new $100,000 mortgage, in other words, beginning April 9, 2012, it will ?require a $1,750 upfront mortgage insurance premium (MIP) to be paid at closing. Upfront MIP is not paid with cash, though. Rather, the FHA automatically rolls the payment into your new loan balance.

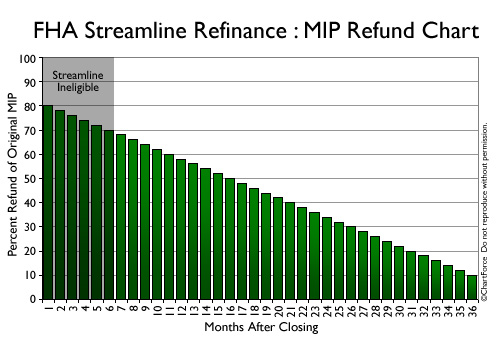

Not all FHA homeowners will pay this full amount, though. One great thing about the FHA Streamline Refinance program is that the FHA offers refund on previously-paid upfront MIP so long as you?re still within the first 3 years of your mortgage.

As an example, refinancing after 11 months grants a 60% refund, but refinancing after 12 months reduces that refund to 58%. This is why is rarely a good idea to ?wait to refinance?.?With the FHA Streamline Refinance, the sooner you refinance, the bigger your MIP refund.

You can review your own FHA mortgage insurance refund chart at top.

Note that FHA mortgages with assigned Case Numbers prior to April 9, 2012 require just a 1.000 percent upfront MIP premium.

Annual MIP

For FHA Case Numbers assigned on or after April 9, 2012, and for loans endorsed on or after June 1, 2009,?the FHA?s new annual mortgage insurance premium are rising across the board.

The new schedule, for loans with case numbers assigned on or after April 9, 2012 :

- 15-year loan terms with loan-to-value over 90% : 0.60 percent annual MIP

- 15-year loan terms with loan-t0-value under 90% : 0.35 percent annual MIP

- 30-year loan terms with loan-to-value over 95% : 1.25 percent annual MIP

- 30-year loan terms with loan-to-value under 95% : 1.20 percent annual MIP

15-year fixed rate mortgages with LTVs of 78% or less pay no annual MIP.

Furthermore, beginning June 11, 2012, all FHA mortgages made for $625,500 or more will be subject to an additional 0.25 percent annual mortgage insurance fee.

A Los Angeles, California homeowner, therefore, using the FHA?s full $729,750 local loan limit for a low-downpayment, 30-year fixed rate mortgage will pay annual mortgage insurance premium of 1.50% to the FHA, or $912 per month.

Loans made prior to April 9, 2012 will use the old FHA mortgage insurance schedule :

- 15-year loan terms with loan-to-value over 90% : 0.50 percent annual MIP

- 15-year loan terms with loan-t0-value under 90% : 0.25 percent annual MIP

- 30-year loan terms with loan-to-value over 95% : 1.15 percent annual MIP

- 30-year loan terms with loan-to-value under 95% : 1.10 percent annual MIP

There is no ?jumbo FHA mortgage premium? for loans made prior to June 11, 2012.

Note that mortgage insurance payments are included in the FHA?s Net Tangible Benefit requirement. You must lower your monthly payment by at 5 percent to qualify for the FHA Streamline Refinance.

Like this:

Be the first to like this post.

flat tax flat tax divine bettie page harry caray maksim chmerkovskiy s.978

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.